Stablecoins: crypto stalemate or currencies of the future?

- James McKay

- Jul 31, 2018

- 8 min read

Updated: Oct 16, 2019

Throughout history, there has been an inherent need for peoples and cultures to have a means to store value and exchange goods and services. The first currencies that moved beyond barter systems were primarily in the form of receipts representing commodities stored in central or communal locations, such as grain silos in the temples of ancient Egypt. With the spread of humans around the globe, new forms of currency were developed. These took one of two forms – items that represented value without inherently storing it, such as beads, shells and tally sticks, and items that stored value in and of themselves, such as gold, silver, and gems.

Over time, as various currencies flourished and others fell by the wayside, their most important characteristics of durability, fungibility, portability, tradability, stability, and value storage, emerged through a process of natural selection.

As the latest revolution in currencies, cryptocurrencies have adopted many of these characteristics. However, in addition to being digital and therefore non-portable, they have also fallen short in areas of stability, and, by extension, tradability. Indeed, it is their extreme volatility that is the most significant factor preventing their wider adoption.

Volatility: the cryptocurrency’s Achilles heel

Most countries today are on what’s known as a fiat currency system: the currency we use is not backed with an equivalent amount of precious metal, or other commodities that are prone to price fluctuations Rather, a fiat currency’s value relies on the 'full faith and credit' of the issuing government, and it is this quality that lends fiat currencies much of their stability.

For cryptocurrencies, this full faith and credit aspect is far murkier, and that, coupled with speculation and other factors, gives rise to frequent bursts of tremendous volatility in the market. Not only does this make it difficult to predict price action, but it also means both merchants and individuals are hesitant to adopt cryptocurrencies as a viable form of payment for goods and services.

Source: CryptoCompare, McKay Research

Stablecoins are a form of cryptocurrency especially designed to address these issues of volatility, and two distinct categories of stablecoin have been developed: crypto-backed stablecoins, which have their value backed by stores of a second cryptocurrency, usually bitcoin or ether, and fiat-backed stablecoins, which have their value backed by real-world fiat currencies like the US dollar or euro.

Same side of a different coin: crypto-backed stablecoins

Crypto-backed, or distributed, stablecoins seek to counteract price volatility by ensuring each unit is fully backed with a reserved amount of a popular cryptocurrency. Put simply, for every unit of crypto-backed stablecoin currency X minted, a pre-determined amount of cryptocurrency Y is locked up in reserve to maintain its value. Although comparisons to the gold standard are accurate to a point, stablecoins are designed to automatically adjust their supply according to market price– issuing new units when they rise in price, and contracting the supply when they fall to bring about price stability. It is this selfcorrecting quality that has led some in the crypto space to refer to them as the ‘holy grail’ of cryptocurrencies and financial technology.

As one of the most popular crypto-backed stablecoins, MakerDAO has the Dai (DAI) coin, a ERC-20 token, as its currency unit, and stores its value in ether. For a user to create Dai coins on the Maker platform, they must do so by utilising ethereum through Maker’s smart contract system to create a Collateralised Debt Position, or CDP.

Specifically, a CDP is generated through a collateralisation process that involves the conversion of ether to ‘pooled ether’ (PETH), which is currently the only collateral type accepted on the platform, and this is followed by placing an order for a set amount of Dai from the CDP itself. Once this order for Dai is placed, the equivalent amount of PETH is locked away in the smart contract and cannot be accessed until the outstanding Dai debt is serviced. When users want to retrieve their collateral, they must send a transaction to Maker, however this can only be done after the outstanding debt in the CDP is serviced, plus interest on this debt, known as the ‘stability fee.’

The other token existing alongside Dai is the Maker coin (MKR), which primarily functions as a governance token to main the MakerDAO ecosystem, as well as playing a role in the collateralising and unlocking process. Maker monitors Dai’s collateral currency (ether), and if the price crashes, new Maker coins are issued and sold to make up the shortfall, reducing the Maker coin price in the process. However, if the collateral currency remains stable, Maker coins are not needed and the supply contracts by destroying a certain volume of Maker coins.

The Maker platform is able to overcome the central issue of cryptocurrency volatility by simply not storing its value in ether; rather, users purchasing Dai lock up a set amount of ether to mint Dai which is then managed against ether’s USD value to sell off or stabilise the ecosystem based on changes in value. The complex interaction of these mechanisms help to reinforce the stable value of the crypto-backed stablecoin in spite of underlying volatility of the cryptocurrency collateral.

DAI coin - 6 month price chart (daily)

Although MakerDAO has found a nimble technological solution around the volatility problem, we have yet to see how much volatility these stable coins would need to be subjected to to experience any catastrophic shifts in value. The MakerDAO platform does technically make provisions for such a scenario through a ‘Global Settlement’ option, which is designed to shut down the entire Maker complex to ensure all users receive the net value of their assets. However, it remains to be seen how this would work in practice.

Other weaknesses include issues of governance, malicious hacking attacks, black swan events, and perhaps most importantly, utility – at this point in their lifecycle, even the largest cryptocurrencies like bitcoin and ether are still not widely adopted.

Systemic Stability: fiat-backed stablecoins

Fiat-backed stablecoins operate as cryptocurrencies but store their value in real-world fiat currencies such as the US dollar or Euro. This keeps their value relatively stable, and active measures are taken to maintain that stability. Some of the most popular and talked-about fiat-backed stablecoins include Tether, TrueUSD, and the upcoming stablecoin from Circle and Goldman Sachs, USD Coin. These coins are popular because they are seen as safe, reliable, and stable, and their fiat collateralisation means that they have huge adoption potential in the cryptocurrency world, with a number of big players backing each.

Circle, in particular, has generated a lot of buzz. The USD Coin they are planning to launch is designed to be regulated and based on existing US monetary transaction law, with a transparent auditing and system design – something that Tether and other stablecoins do not yet offer.

In the meantime, with Circle still on the horizon, Tether remains the most popular fiat-backed stablecoin in terms of market share ($2.7 billion, making it the eleventh largest cryptocurrency overall). Tether offers USD coins in the form of USDT, which maintain a value of $1 USD per 1 USDT. Like all cryptocurrencies, it is built on open, distributed blockchain technology for security and transparency, and due to its size and popularity, it is available on a large number of popular cryptocurrency exchanges. Tether is backed by US dollars which it holds in reserve as the collateral for the currency. And true to its nature as a fiat-backed stablecoin, its value has remained remarkably stable, with the few fluctuations in value coming as result of large shifts in the underlying value of the US dollar.

Overall, these fiat-backed stablecoins address some of the issues of cryptocurrencies and represent a 'middle ground' between traditional currencies and cryptocurrencies, and traditional currencies and crypto-backed stablecoins. This includes volatility – being based on real-world currencies goes some way to reducing the cryptocurrency volatility issue.

However, there are also risks associated with fiat-backed stablecoins. The essential characteristic and raison d'être of cryptocurrencies is that they are decentralised and democratic – they do not rely on any sovereign government or central bank. This is part of their appeal – a global, unbiased monetary system for transferring funds and buying goods and services.

Pegging the value of a stablecoin to a real-world fiat currency immediately brings in a degree of centralisation to the system, since it is now effectively beholden to the authority of a central bank or government, thus making it more susceptible to being shut down summarily.

Further, in the case of many coins, the question of governance, transparency, and system reliability are suspect. Existing fiat-backed cryptocurrencies are not audited in a traditional fashion, nor do they have the level of transparency that a traditional currency system does, and therefore, there are unanswered questions as to their stability, longevity, and operations – all of which could adversely affect their adoption or utility.

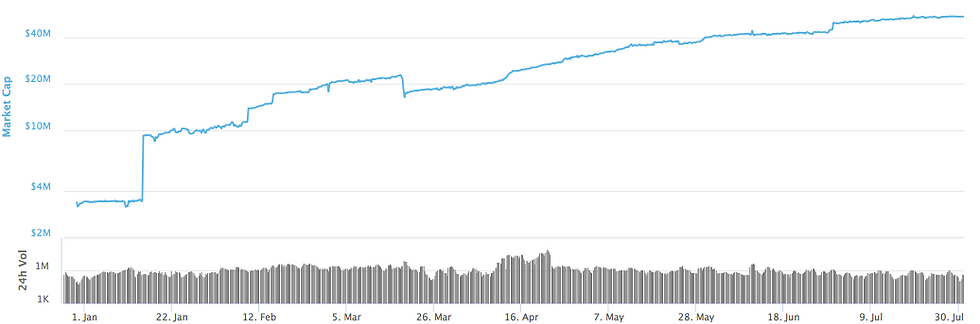

DAI coin market capitalisation

Source: CoinMarketCap

Tether market capitalisation

Source: CoinMarketCap

Despite these shortcomings, many see fiat-backed stablecoins as a way to bridge the gap between crypto and traditional currencies, essentially providing the best of both worlds. People want usable cryptocurrencies which offer all the decentralised, semi-anonymous and utilitarian benefits, with a reliable, stable valuation, so they are naturally flocking to fiat-backed stablecoins; a trend reflected in their significantly higher market capitalisation relative to Dai and other crypto-backed stablecoins. And, like most currencies, the more individuals and businesses who place their faith in them, the more likely they are to survive and succeed.

What does the future hold for stablecoins?

Given the speed of their ascendancy and the attention they are garnering in the market, both stablecoin variants are likely to be around for some time to come. If cryptocurrencies are to survive in general, a stable and viable currency will need to be developed that balances the free-wheeling world of the crypto 'Wild West,' and the regulatory structures that characterise traditional currency systems. The ability of the current crop of stablecoins to balance these qualities will play a big role in determining their longevity going forward.

As has been the case with traditional cryptocurrencies, however, much uncertainly stems from the potential actions of governments and financial institutions in the stablecoin space. For example, the support of various fiat-backed stablecoins by major financial players, such as Goldman Sachs in the case of Circle’s USD Coin, is a promising sign but it remains to be seen what influence broad institutional involvement will have on the price stability mechanisms and technological architecture of stabcoins. Additionally, it is clear that the continued growth of cryptocurrencies will reach a critical mass beyond which governments will not sit idly by and relinquish control of the medium of exchange. With their strong fiat component, stablecoins may be the first domino to fall if and when cryptocurrency taxation measures are introduced. However, it should be noted that governments also may have limited options to intervene, such that forging alliances with financial institutions and fiat-backed stablecoins, and implementing some regulatory regimes over them may be the path of least resistance. This tacit endorsement would also have the effect of rapidly increasing adoption of a particular stablecoin or set of stablecoins.

In conclusion, stablecoins may not yet be the ‘holy grail’ – they still require better governance, transparency, and perhaps a more diversified store of value (the US dollar or Euro are far from perfect sources of collateral). Further, systems to make fiat-backed or crypto-backed stablecoins easier to understand, purchase, trade, and utilise are as critical to their future success as the ultimate outcomes of government involvement. For now, however, stablecoins are the first step towards a usable cryptocurrency system that might one day supplant our existing fiat currencies – though likely not any time soon.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional before making an investment decision.

Comments